AML and CFT Rules for Trusts & Service Providers in the UAE

In the UAE, trusts and corporate service providers (TCSPs) manage legal persons and legal arrangements. However, they face high risks of money laundering (ML) and terrorism financing (FT). To combat these risks, authorities enforce AML and CFT laws with stringent compliance requirements. A trustee, secretary, or partner involved in creation, establishment, or directorship must perform proper due diligence. This step prevents the misuse of money and ensures accountability. If firms ignore regulations, they risk engaging in suspicious transactions with other countries where oversight is absent. As a result, their exposure to financial crime may increase.

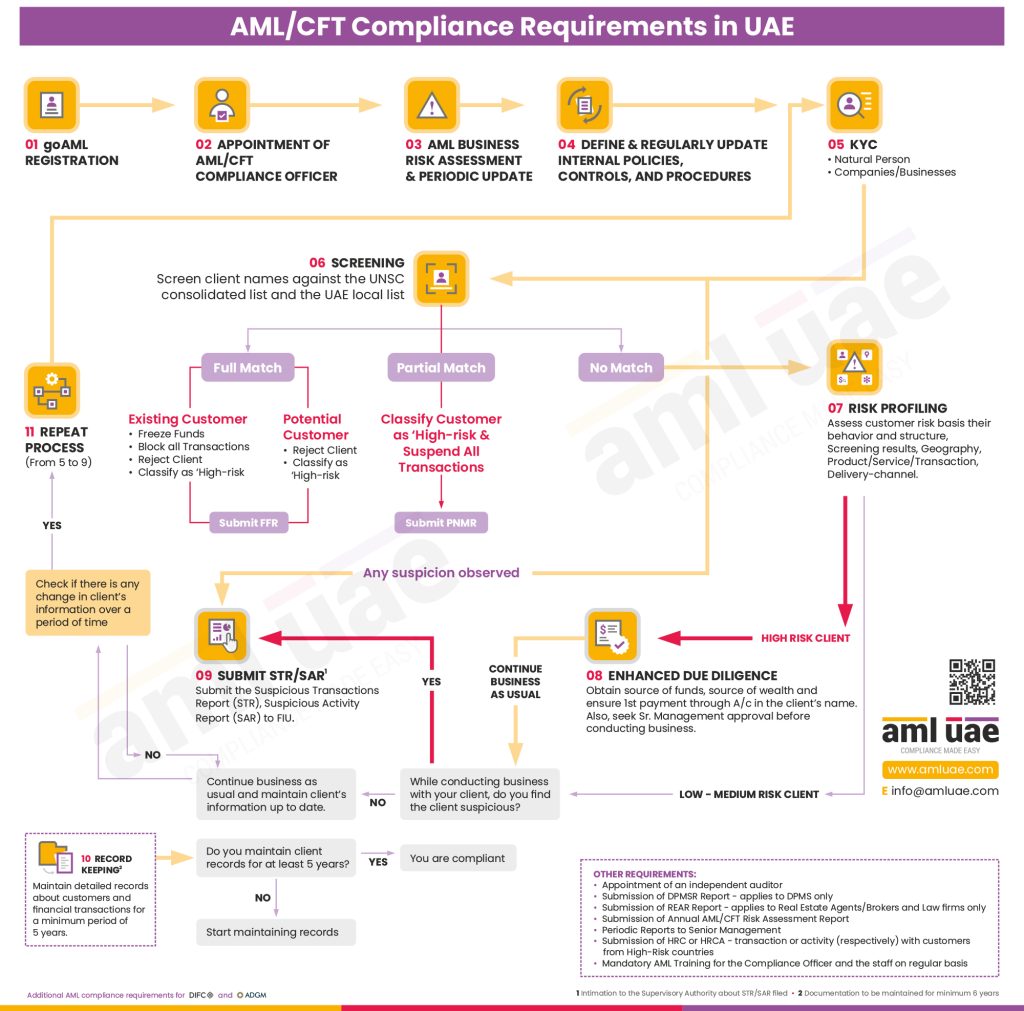

Here are the key AML and CFT requirements:

- Maintain a registered office, work address, or administrative address to ensure transparency in dealings.

- Prevent the abuse of corporate vehicles by monitoring correspondent addresses and nominee shareholders.

- Strengthen collaboration with financial services to detect and prevent high-risk activities.

- Identify and report suspicious transactions linked to financers or illicit financial activities.

- Ensure every agent involved in company structuring follows strict conduct guidelines.

- Comply with regulatory requirements to prevent exposure to absent controls in other countries.

- Regularly update internal policies to address new AML and CFT threats.

By following these rules, TCSPs and trusts in the UAE can protect their businesses and meet AML and CFT compliance standards.

Suspicious Transactions Indicating ML/FT Risks in TCSPs

How TCSPs Can Identify and Prevent Financial Crimes

In the UAE, TCSPs manage business relationships and handle legal entities, making them targets for ML/FT risks. These risks exist at both enterprise and customer levels. Some clients try to hide their beneficial ownership using nominee agreements, while others provide fake identity documents or wrong addresses. Additionally, businesses may use third-party transactions with an unknown identity or an unusual payment method to avoid detection. Without strict monitoring, these arrangements can result in criminal transactions and movement of illicit funds through unauthorized transactions. Furthermore, companies based in tax havens or regions with high corruption, terrorist organizations, and a weak AML/CFT regime pose significant debt and country risks to financial systems.

To prevent financial crimes, watch for these red flag indicators:

- Clients creating complex company structures to engage in layering and conceal illicit funds.

- Businesses involved in multiple invoicing, over-invoicing, or under-invoicing to manipulate transaction records.

- Firms conducting excessive cash transactions or holding disproportionate funds without clear financial backing.

- Entities with high levels of assets but frequently changing their organizational structure.

- Clients avoiding direct payments, instead using a third party with an unknown identity.

- Companies linked to PEPs, individuals under sanctions, or firms operating in tax havens.

- Use of bribes to bypass regulations and conduct illegal transactions through accounts.

To stay compliant with AML and CFT laws, TCSPs must track these transaction risks and enforce strong accounting controls. Proper oversight helps prevent financial crimes and ensures regulatory compliance.

AML Compliance Rules for Trusts & Corporate Service Providers in the UAE

In the UAE, TCSPs must follow strict AML compliance measures to prevent financial crimes. The Decree-Law No. 20 of 2018 on Anti-Money Laundering and Combating the Financing of Terrorism sets the foundation for regulating business relationships and financial transactions. Additionally, Cabinet Decision No. 10 of 2019 provides an Implementing Regulation to guide companies in following AML/CFT programs. These rules require firms to establish internal policies, apply customer due diligence, and implement clear procedures. This helps detect suspicious transactions and reduce risks associated with money launderers and financial criminals.

To enhance protection against fraud, TCSPs must comply with strict regulations and maintain a strong governance framework. They must also report any suspicious transactions and verify that their clients meet legal standards. These obligations help identify Illegal Organizations, prevent fraud, and ensure compliance in financial activities. By following these provisions, firms can minimize ML and FT risks while securing the financial system.

Essential AML/CFT Compliance Guidelines for Trusts & Corporate Service Providers in the UAE

Trusts and corporate service providers must adhere to these essential requirements under the AML regulations in the UAE:

Identifying Potential ML/FT Risk Exposure

Understanding exposure to ML and FT is essential for TCSPs to follow AML/CFT measures and prevent financial crimes.

- Review business relationships, client risks, and complexity of financial transactions to spot potential threats.

- Examine the country of origin, country of operations, and geographical sources to detect risks from a foreign client.

- Monitor channel risk, preferred mode of communication, and financial arrangements to identify any unusual nature of dealings.

- Apply a risk-based approach, maintain proper documentation, and assign a risk rating for efficient management and compliance.

Enforce Customer Due Diligence Procedures

To prevent financial crimes, TCSPs must apply strict customer due diligence (CDD) measures. Verifying a client’s identity and checking their background information helps ensure compliance and reduce ML and FT risks. Screening against Sanction lists can reveal connections to PEPs, money launderers, or third-party intermediaries. Additionally, businesses must assess financial transactions, business activities, and legal arrangements to uncover hidden risks.

- Conduct a thorough assessment of the client profile to detect irregularities in acquisition, transfer, or financing activities.

- Verify the beneficial owner using independent sources and investigate hidden ownership through proxies or complex structures.

- Scrutinize legal arrangements that appear opaque or involve excessive influence over business operations.

- Perform regular screening of clients and partners to ensure reliability in financial transactions.

- Maintain continuous scrutiny of financial instruments to identify unusual transactions and potential risks.

Establish Internal Policies, Controls, and Compliance Procedures

To minimize ML and FT risks, trusts and company service providers must establish strong and effective internal policies. These policies should include customer due diligence, suspicious transaction reporting, and record-keeping. Additionally, maintaining proper governance and structured procedures ensures legal compliance and supports risk mitigation. Conducting regular assessments keeps policies updated and aligned with regulatory requirements.

Organizations must focus on the implementation of strict controls to strengthen risk management. Routine updates are necessary to address new threats and evolving compliance rules. Applying effective measures enables businesses to meet AML and CFT standards while securing financial operations.

Notify the Financial Intelligence Unit (FIU) About Suspicious Transactions

Businesses must report suspicious transactions to the Financial Intelligence Unit (FIU) to prevent AML and CFT violations. Monitoring risk profiling and identifying unexplained transactions ensures compliance. Any complex transactions with an unknown beneficial owner or unclear sourcing of funds should raise concerns. Companies must exercise vigilance and keep updates on every alleged transaction.

- Report suspicious transactions linked to high-risk countries or involving an unrelated third party.

- Flag ownership changes that lack a clear reason or involve hidden entities.

- Investigate dubious transactions that do not align with the client’s income or turnover.

- Ensure due diligence measures are followed when verifying proofs of financial activity.

- Watch for customer refusal to provide relevant information required for compliance.

- Submit reporting on all unusual activities that may suggest financial misconduct.

- Track and document involvement in transactions that seem fraudulent or excessive.

Continuous Oversight

TCSPs must perform monitoring to prevent money laundering and financial crimes in their business relationships. Regular detection of unusual patterns in transactions, transfers, and payments helps identify risks early. Any inconsistencies in a client’s profile, identity, or history should be verified through registries to ensure accuracy.

- Track frequency, size, and amount of transactions to detect unusual financial behavior.

- Verify third-party accounts, foreign accounts, and unknown sources to prevent financial fraud.

- Stay alert for clients from high-risk countries or linked to PEPs, especially before account closure or during the account life cycle.

Conclusion

For TCSPs and company service providers in the UAE, following AML and CFT regulations is crucial to minimizing risks. A strong fight against money laundering begins with proper due diligence, accurate identification, and strategic management of business relationships. Recognizing terrorism financing risks and using best practices can help prevent fraudulent transactions and reduce exposure to financial crime.

Collaborating with AML consultants provides professional, industry-specific support for implementation. Keeping up with international regulations, global regulations, and national measures enhances financial security. Trusts and service providers must regularly improve their compliance strategies to maintain financial stability and integrity.

Importance of AML Regulations in the UAE

Ensuring AML and CFT compliance is essential for businesses operating in the UAE. A well-structured AML compliance department helps companies implement internal controls, follow guidelines, and meet global regulations. Proper risk profiling and CDD measures reduce financial risks while improving business operations. Using AML software enhances screening and filing processes, ensuring adherence to national boundaries and best practices.

- Assist in the selection and submission of risk assessment reports to the UAE government.

- Conduct training for employees on KYC, EDD, and financial crime prevention.

- Ensure effective implementation of procedures and firm-specific policies.

- Manage AML-related activities through structured STRs filing and monitoring.

- Engage an expert team for conducting audits and ensuring legal compliance.

Frequently Asked Questions (FAQs)

1: Why is sanction screening and PEP screening important in the onboarding process?

Sanction screening and PEP screening help detect high-risk customers and prevent money laundering. These checks ensure transparency in financial dealings and stop criminals from misusing client accounts. By identifying illicit funds and suspicious assets, businesses can follow AML/CFT regulations and maintain compliance.

2: What is the role of a compliance officer in AML/CFT compliance?

A compliance officer oversees internal policies, procedures, and controls to ensure adherence to AML/CFT regulations. They conduct audits, perform reviews, and suggest improvements where needed. Their duties include training compliance staff, assessing proficiency, and ensuring businesses operate with diligence.

3: How do TCSPs and trusts face risks of money laundering?

TCSPs and trusts are at risk when clients lack transparency, engage in unusual transactions, or attempt to hide ownership of legal entities. Criminals may use these services for capitalization, acquisition, or transferring proceeds from illicit funds into the financial system. To mitigate these risks, businesses must monitor legal arrangements and restrict unauthorized access.