Predicate offences are serious crimes that act as a foundation for illegal activities, including money laundering. These crimes work within an interconnected network, often triggering or protecting other criminal acts. To combat such threats, organizations follow international standards and adopt a strong regulatory framework. The impact of ignoring these offences can lead to financial instability and significant legal risks. Therefore, understanding how they are executed and what drives them is critical. Companies must apply best practices and stay compliant with relevant regulations. This approach helps them create a shield against risks and overcome associated challenges effectively.

What is a Predicate Offence? Definition and Example Explained Simply

A predicate offence is a crime that can trigger serious financial crimes, including money laundering or terrorism financing. These offences form a tangled web of illegal actions, often fueled by illicit funds from tax evasion or corruption. Gradually, these funds are converted into legitimate income, making it harder to track their true source. As a result, criminals successfully hide their illegal gains. Consequently, financial crime creates severe risks for the economy, making it a top concern for global regulators and enforcement agencies.

Understanding Predicate Offences in Money Laundering

Money laundering hides the source of money earned through a predicate crime or other criminal activity. These predicate offences serve as the basis for laundering proceeds of crime, such as illicit gains from human trafficking or other illegal activities. To counter ML/TF, governments worldwide have criminalised these offences. Moreover, local and international bodies have classified 21 major predicate offences to improve regulation. Since money laundering is rarely done in isolation, focusing on the underlying crimes is essential for prevention.

Understanding Predicate Offence under UAE AML/CFT Laws

What is a Predicate Crime? Explanation under UAE Laws

Under UAE laws, a Predicate Offense refers to any act that qualifies as a felony or misdemeanour. This crime can be committed inside or outside the country but must be punishable in both places—UAE and the other country where it happened. The AML/CFT regulations also include money laundering and related predicate offences in the definition of a crime. Ensuring compliance with these regulations is critical to avoid serious legal consequences.

Why Understanding Predicate Offences Matters

Predicate offences are the point of origin or source for Money Laundering activities. These offences generate proceeds that are later concealed through the act of laundering. Regulated Entities aiming to counter laundering risks must understand how underlying operations depend on these offences. A comprehensive understanding of relevant predicate offences is crucial, as the success of identifying and mitigating risks is dependent on this knowledge. Without the ability to fully comprehend these offences, managing and reducing financial crime threats becomes far more challenging.

Key Stages of Money Laundering and Related Predicate Offences

Money Laundering happens in three stages: placement, layering, and integration. In the placement stage, illegal proceeds from a predicate offence enter the financial system to conceal their illicit origin. Next, layering hides the laundered proceeds by transferring them across various accounts, making them harder to trace. Finally, in integration, the funds are merged into the economy, appearing as legitimate money. Sometimes, part of these funds is used to commit new predicate offences, creating a cyclical chain of crime that continues the process. This connecting link between offences and laundering makes it crucial to understand and prevent such activities.

Effects and Consequences of Predicate Offences

Predicate offences have a serious impact on businesses, institutions, and the entire economy. Vulnerable sectors face legal risks, operational risks, and social costs, such as damage to their reputation or a drop in credit score. Tax crime, fraud, insider trading, and market manipulation weaken the financial system, causing a loss of revenue for the government and reducing foreign investment. Additionally, money laundering risks, terrorism, and terrorism financing risks threaten national security and disrupt society. This increased exposure to crime affects the stability of a country, leading to long-term economic damage.

Regulatory Framework and Standards for Predicate Crimes

FATF Predicate Offences

The Financial Action Task Force (FATF) plays a vital role in defining and monitoring predicate offences. FATF sets AML/CFT standards that countries follow to fight money laundering and terrorist financing. Known as FATF’s 40 Recommendations, these guidelines act as the Northern Star, helping countries implement strong anti-money laundering measures. Among these recommendations is a comprehensive list of predicate crimes, covering a wide range of serious offences that can lead to laundering funds.

Designated Categories of Predicate Crimes

FATF classifies predicate offences into various designated categories, ensuring countries address the broadest possible range of illegal activities. These include felonies and misdemeanours that are often criminalised internationally. Examples include trafficking in human beings, migrant smuggling, extortion, and bribery. Financial-related crimes such as tax crimes (direct taxes and indirect taxes), insider trading, and market manipulation are also part of this list. Moreover, environmental offences like environmental crime and serious violent crimes such as murder, kidnapping, and grievous bodily injury are included as predicate crimes.

Common Predicate Offences in Money Laundering

Here are some of the most common predicate crimes according to FATF:

- Corruption and bribery

- Forgery and counterfeiting currency

- Trafficking in narcotic drugs and psychotropic substances

- Robbery, theft, and smuggling

- Piracy and counterfeiting products

- Organised criminal group activities and racketeering

- Illegal restraint and hostage-taking

- Trafficking in stolen goods

Each of these crimes provides an opportunity for criminals to launder funds through various channels, including customs fraud, excise duties violations, and counterfeiting products. Understanding and enforcing regulations for these offences is crucial to safeguard national and global financial systems.

EU Directives on Combating Money Laundering

The EU’s first directive set the foundation for fighting predicate offences, aligning with the 1988 Vienna Convention. It urged member nations to expand the scope to include other countries and crimes.

Global Framework for Regulating Predicate Offences

The global regulatory framework for Predicate Offences varies across countries due to differences in criminal codes and economy. In the UAE, Federal Decree-Law No. (20) of 2018 on Anti-money Laundering and Combating the Financing of Terrorism defines a predicate offence as any offence or misdemeanour under UAE laws. This applies whether the offence is committed within UAE or outside UAE, provided the principle of dual criminality is met. These regulations aim to address crimes that fund illegal organisations and protect the market from financial abuse.

UAE National Risk Assessment 2018: Focus on Predicate Offences

The UAE National Risk Assessment (NRA) in 2018 evaluated Money Laundering risks and identified several predicate crimes posing serious threats. Based on FATF 21 predicate offences, the assessment highlighted the following high-risk crimes:

- Fraud

- Counterfeiting and piracy of products

- Illicit trafficking in narcotics

- Professional third-party ML

- Various other predicate crimes closely linked to Money Laundering activities

By identifying these risks, the NRA helps improve the country’s efforts to tackle financial crime and protect its economy.

How to Identify and Report Predicate Offences in the UAE

Identifying Predicate Offences in the UAE

In the UAE, Financial Institutions (FIs) and Designated Non-Financial Businesses and Professions (DNFBPs) must follow AML/CFT laws to detect and report predicate offences. Indicators like unusual transactional patterns or inconsistent financial status compared to business activities help identify potential risks. Cabinet Decision No. (10) of 2019 and Decree Law No. (20) of 2018 require entities to stay vigilant and report any suspicious transaction.

Role of the Financial Intelligence Unit (FIU)

The Financial Intelligence Unit (FIU) in the UAE monitors suspicious activities. FIs and DNFBPs must submit Suspicious Activity Reports (SAR) or Suspicious Transaction Reports (STR) through the goAML portal. This goAML Suspicious Transaction Reporting System ensures that suspicious activities related to ML/TF risks and Illegal Organisations are flagged and investigated.

Common Red Flags and Compliance

Compliance Officers help enforce internal rules and controls to reduce risks. They must track and update red flags regularly. Here are some common signs:

- Transactions linked to high-risk jurisdictions

- No clear source of funds explanation

- Inconsistency between financial status and declared professional activities

- Repeated unusual transactional patterns

- Sudden involvement in high-value transactions without clear business justification

By closely following procedures and appointing a Compliance Officer, FIs and DNFBPs can better safeguard against financial crimes.

Key Challenges in Combating Predicate Offences

Investigative Challenges in Combating Predicate Offences

Financial Intelligence Units (FIUs) face difficulties in investigating predicate offences due to the intricate network of entities involved. Linking Money Laundering to a crime requires gathering reliable evidence and identifying complex connections.

Legal Complexities and Cross-Border Issues

The cross-border nature of predicate offences complicates investigations due to varying legal frameworks and jurisdictional complexities. Lack of mutual cooperation and bureaucratic delays further slow down efforts to tackle these crimes.

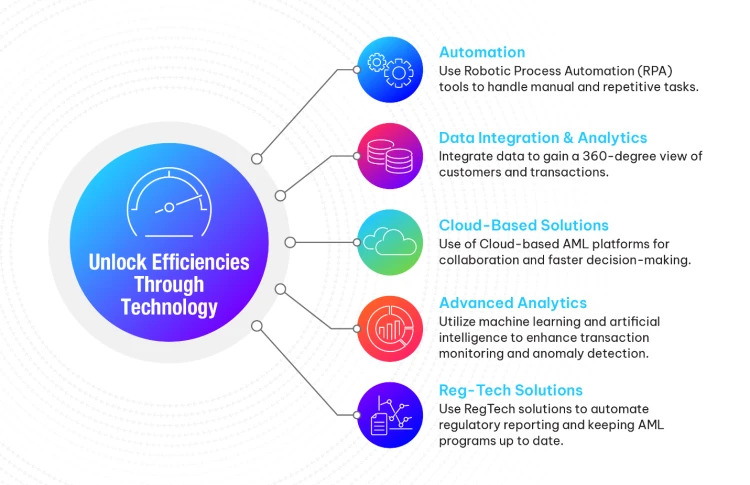

Evolving Threats with Technology

As technology advances, new threats like cybercrime and cryptocurrency-related crimes emerge, making it difficult for DNFBPs and FIs to detect suspicious activities. These sophisticated activities constantly evolve, challenging traditional monitoring systems.

Resource Constraints and Expertise

Many Regulated Entities lack the necessary resources and well-trained staff for effective AML compliance. This shortage hinders their ability to fulfil regulatory obligations and meet the required regulatory standards.

Key Focus Areas for Compliance

To address these challenges, DNFBPs and FIs should focus on:

- Strengthening compliance programs

- Training well-trained staff in AML compliance

- Collaborating with regulatory authorities for mutual cooperation

- Adapting to technology advances and monitoring suspicious activities

- Allocating adequate resources to meet regulatory framework requirements

By implementing these strategies, entities can better manage the risks posed by predicate offences and illicit acts.

Liability for Predicate Offences under UAE AML/CFT Regulations

Under UAE AML/CFT laws, a person committing a predicate offence can also be found guilty of money laundering if they knowingly handle funds from an illicit source. Such individuals may be charged and punishable for both offences as independent crimes. This includes acts like hiding, transmitting, or possessing the proceeds of these crimes or helping other perpetrators escape punishment. The AML/CFT law ensures that offenders cannot avoid accountability, even if the crimes seem unrelated.

To safeguard against ML/FT threats, companies must build a robust AML framework. This requires skilful employees and knowledgeable employees to implement an effective compliance program. Regular AML training ensures senior management and staff have a consistent understanding of their role in detecting threats and protecting the company’s reputation. Key steps to strengthen your compliance strategy include:

- Regular AML training for all levels, including senior management

- Appointing skilful employees to oversee compliance

- Creating a robust AML framework with clear reporting processes

- Monitoring for ML/FT threats and unusual activities

- Aligning with organisational objectives to promote a strong compliance culture

Effective Strategies to Combat Predicate Offences

1. Risk-Based Approach (RBA)

The Risk-Based Approach (RBA) helps Regulated Entities prioritize their AML compliance by applying stronger controls where ML risks are higher. The principle is simple—higher the risks, stronger the controls. This approach ensures better detection and mitigation at an early stage.

2. Customer Due Diligence (CDD)

Customer Due Diligence (CDD) involves collecting customer information, such as name, date of birth, nationality, and verifying it against official documents like a Driving License or ID Card. CDD ensures the legal nature of the customer’s business relationship is understood, reducing risks.

3. Know Your Customer (KYC)

KYC is an essential part of CDD. It requires DNFBPs and FIs to verify the customer identity by collecting relevant documents. This process helps ensure the customer is not involved in corruption, fraud, or drug dealing that could pose ML risks.

4. Name Screening

Name screening helps detect potential risks by matching customer details with Sanctions Lists, Politically Exposed Person (PEP) databases, and adverse media sources. This step is critical in identifying customers who may be involved in predicate offences or terrorism-related activities.

5. Risk Profiling and Assessment

Based on KYC and name screening, DNFBPs and FIs can classify customers into high-risk, medium-risk, or low-risk categories. Risk Profiling ensures that appropriate Enhanced Due Diligence measures are applied for high-risk customers.

6. Enhanced Due Diligence (EDD)

EDD is conducted for high-risk customers and involves collecting additional information, such as Source of Wealth and Source of Funds. Senior management approval is required before onboarding such customers to ensure thorough risk assessment.

7. Transaction Monitoring

Transaction monitoring is vital for identifying suspicious activities. DNFBPs and FIs must monitor transactions regularly to ensure they align with the customer’s transaction history and business relationship. Any unusual patterns should be treated as a red flag indicator.

8. Training and Awareness

Regular training for employees and senior management ensures a consistent understanding of AML compliance policies. This equips them to recognize suspicious transactions and implement internal procedures to combat predicate offences effectively.

9. Using AML Software

Modern AML software based on cutting-edge technologies helps address challenges like resource limitations and accuracy issues. These tools improve transaction monitoring and name screening, making compliance more efficient.

10. Collaborative Approach

A collaborative approach through public-private partnerships, information sharing, and transparency strengthens efforts to combat Money Laundering and predicate offences. Greater cooperation among stakeholders enhances detection and prevention.

Final Thoughts

A comprehensive understanding of predicate offences allows Financial Institutions (FIs) and Designated Non-Financial Businesses and Professions (DNFBPs) to strengthen control and reduce risks of money laundering and terrorism financing. This proactive approach ensures these entities can identify threats early and implement better prevention strategies for compliance and security.

FAQs

What is a predicate offence?

A predicate offence is a crime that leads to another serious financial crime, like money laundering or terrorism financing.

Why are predicate offences important in AML compliance?

Understanding predicate offences helps detect and prevent money laundering risks, enabling FIs and DNFBPs to implement stronger controls.

How do Financial Institutions (FIs) identify predicate offences?

FIs use Customer Due Diligence (CDD), name screening, and transaction monitoring to detect red flag indicators linked to predicate offences.

What role does a Risk-Based Approach (RBA) play in combating predicate offences?

The RBA ensures that entities focus their resources on high-risk areas, applying stronger controls to manage significant risks.

How can DNFBPs and FIs improve their AML compliance?

They can adopt AML training, use cutting-edge AML software, and build a robust AML framework to detect and mitigate ML/FT risks effectively.