Blog

Empower yourself with knowledge! Future Audit offers a wealth of free resources to keep you informed on the latest AML/CFT (Anti-Money Laundering and Combating the Financing of Terrorism) regulations and best practices in the UAE.

The Latest In Compliance

Our comprehensive blog features insightful articles, industry updates, and expert advice to help you navigate the ever-changing compliance landscape. Whether you’re just starting your AML/CFT journey or looking to stay ahead of the curve, our free resources are your one-stop shop for valuable knowledge and practical guidance.

How to Remain Compliant with Sanctions Screening Requirements in the UAE

How to Remain Compliant with Sanctions Screening Requirements in the UAE By Future Compliance | FTIAudit.com Sanctions screening is a critical component of the UAE’s Anti-Money Laundering (AML) and Counter-Terrorist

AML Compliance Training: A Complete Guide for Financial Institutions

Introduction AML (Anti-Money Laundering) compliance training is a critical requirement for financial institutions, fintech companies, and other regulated businesses. Regulatory authorities such as the Financial Action Task Force (FATF), Financial

The Role of Charity (Zakat) in Ramadan: A Financial Perspective

Ramadan is a month of worship, self-discipline, and generosity. Among its many spiritual obligations, charity holds a special place. Zakat, the mandatory almsgiving in Islam, plays a crucial role in

How to Budget Smartly for Ramadan: Tips for Saving and Giving

Ramadan is a time of spiritual growth, generosity, and self-discipline. However, with increased expenses on food, charity, and gifts, it’s easy to overspend. A well-planned budget can help you manage

The Spiritual and Financial Blessings of Ramadan

Ramadan, the holiest month in Islam, is a time of spiritual reflection, self-discipline, and increased devotion. It is also a period that brings significant financial awareness and blessings. Muslims worldwide

AML Compliance During Ramadan: Best Practices for Financial Institutions

Introduction Ramadan is a time of increased financial activity, including charitable donations, business transactions, and money transfers. While this period fosters generosity, it also poses money laundering and financial crime

The Role of Technology in AML Compliance for Islamic Banking During Ramadan

Introduction Islamic banking operates under Shariah-compliant financial principles, ensuring that transactions are ethical and interest-free. During Ramadan, financial activities surge due to increased Zakat payments, remittances, and business transactions. This

How Businesses Can Ensure AML Compliance in Ramadan Promotions & Discounts

Introduction Ramadan is a peak season for businesses, with many offering special promotions, discounts, and cashback deals. However, the rise in financial transactions during this period increases the risk of

Increased Money Transfers in Ramadan: How to Detect Suspicious Transactions

Introduction Ramadan is a period of increased financial activity, with a significant rise in money transfers. Many people send remittances, business payments, and charitable donations during this time. However, this

Best Practices for AML Compliance in Charity & Zakat Donations

1. Verifying Charitable Organizations Before donating or processing payments, financial institutions and individuals should:Check official charity registries to confirm legitimacy.Ensure the charity provides clear records of fund distribution.Monitor charities flagged

Comprehensive Guide to Implementing an Effective Remedial Action Plan (RAP) for AML/CFT Compliance

In the realm of Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT), maintaining robust compliance frameworks is paramount. When supervisory authorities identify deficiencies within an entity’s AML/CFT measures,

Understanding AML Lines of Defense: A Comprehensive Guide

Understanding the Three Lines of Defense in AML First Line of Defense: Operational Management Operational management forms the frontline in the battle against money laundering. This line includes departments and

AML Risk Assessment: A Complete Guide

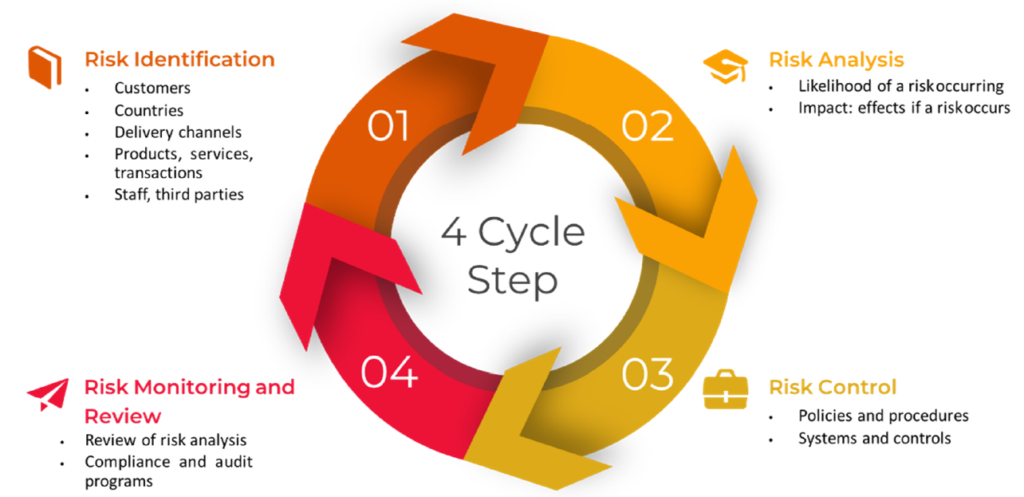

AML/CFT Risk Assessment UAE Report: A Complete Guide Introduction The Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) Risk Assessment in the UAE is a crucial process for

Essential AML Lines of Defense: Protect Your Business Now!

In my years of experience working with regulated entities, I’ve seen how crucial a strong risk management system is for preventing financial crime. One of the most effective frameworks used

10 Essential Books About Money Laundering That Expose Secrets

1: Handbook of Anti-Money Laundering by Dennis Cox: A Must-Read Guide Money laundering harms financial systems worldwide. That’s why understanding its real-life impact is essential. Experts have developed practical strategies

Alarming Blacklist Countries 2024 – What It Means for You!

Which Countries Are on the FATF Blacklist and Grey List? The Financial Action Task Force (FATF) plays a big role in keeping the global financial system safe. As an independent

Terrifying Truth: How Terrorist Financing Really Works

Terrifying Truth: How Terrorist Financing Really Works Introduction: The Dark Reality of Terrorist Financing Terrorist organizations need significant financial resources to recruit operatives, execute attacks, and sustain their operations. Despite

AML Risk Assessment: Essential Secrets to Stay Safe

Introduction For over 20 years, I have helped financial institutions improve their AML strategies. One major challenge is maintaining the accuracy of their risk scoring model in a rapidly data-driven

The Ultimate Guide: What Is Predicate Offence? Uncover the Mystery

Predicate offences are serious crimes that act as a foundation for illegal activities, including money laundering. These crimes work within an interconnected network, often triggering or protecting other criminal acts.

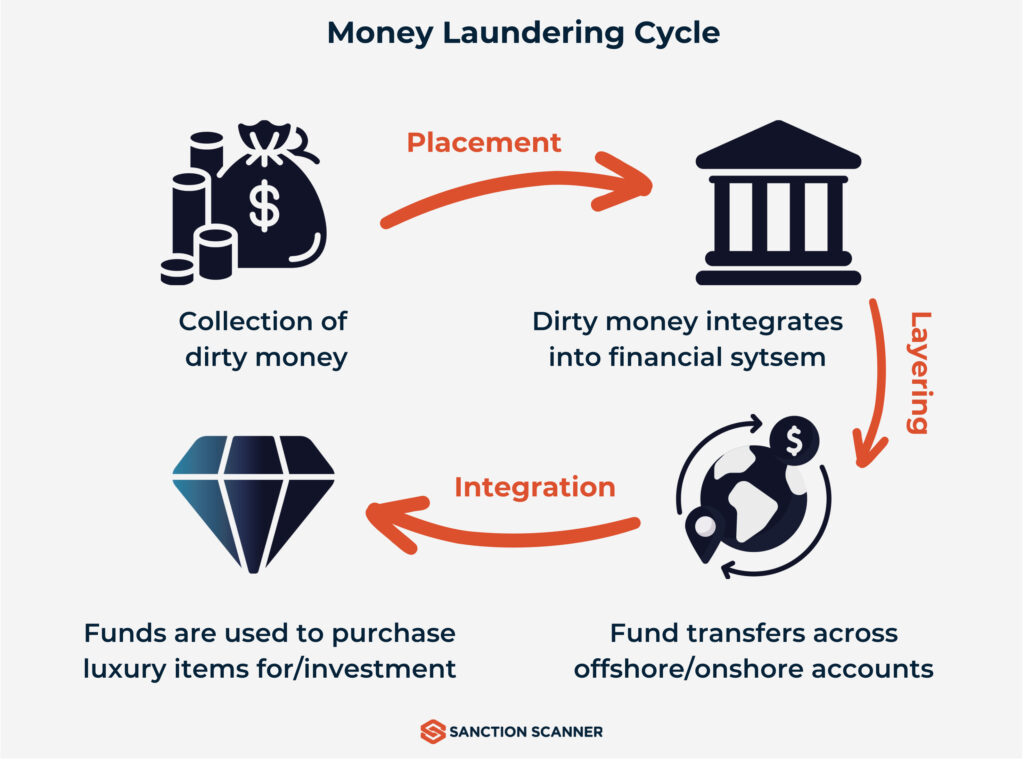

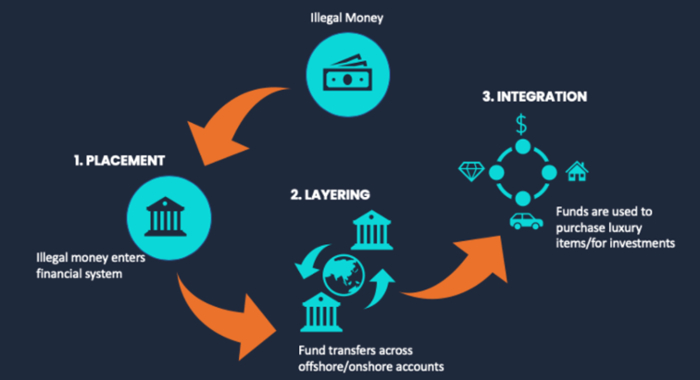

Revealing the Stages of Money Laundering: Surprising Secrets

Money laundering is a complex process in which criminals, initially, generate more illegal funds by hiding the origin of money gained from illegal activities like drugs, bribery, and human trafficking.

Ultimate Guide: AML and CFT Tactics to Stop Dirty Money!

In the UAE, trusts and corporate service providers (TCSPs) manage legal persons and legal arrangements. However, they face high risks of money laundering (ML) and terrorism financing (FT). To combat

Ultimate Guide: The Crucial Difference Between AML and KYC!

Many people think Know Your Customer (KYC) and Anti-Money Laundering (AML) are the same, but they differ in key ways. KYC helps financial institutions verify customer identities and meet legal

Proliferation Financing Exposed: A Hidden Threat

In today’s world, proliferation financing (‘PF’) is a growing global threat that fuels the spread of WMD programs. It involves raising and making available funds, assets, and other economic resources

What Is Smurfing? The Alarming Truth You Need to Know!

What if criminals could secretly move illegal money without setting off alarms? This is exactly how smurfing works—a deceptive money laundering technique where large amounts of cash are broken down

Why AML Training is Critical for Your Employees

Introduction In today’s complex financial landscape, Anti-Money Laundering (AML) training is a vital element for businesses to protect themselves from financial crimes. The increasing sophistication of money laundering techniques means

How the Socio-economic Impact of Money Laundering Hurts Us

Socio-Economic Impact of Money Laundering in the UAE Money laundering is a global issue that poses significant risks to economies and societies, but in the context of the United Arab

7 High-Risk Customer Types That Could Destroy Your Business!

Businesses must stay alert when dealing with high-risk customers to prevent fraud, money laundering, and terrorist financing. From my experience, financial institutions that follow a risk-based approach can identify threats

How the Socio-economic Impact of Money Laundering Hurts Us

Money laundering is a serious crime that allows criminals to hide illegal funds and expand their criminal pursuits. It fuels illegal activities such as drug trafficking and terrorist financing, making

Disturbing Secrets of Layering in Money Laundering Unveiled!

Definition & Stages of Money Laundering How Money Laundering Works Money laundering is a financial crime where criminals hide illegally obtained funds to make them seem legitimate. One crucial part

Shocking Truth: How Placement in Money Laundering Works!

The placement stage is the most critical part of money laundering. Here, criminals sneak their illegal money into the banking world, making it seem regular. They use different methods and

Shocking Secrets: How Money Laundering Really Works!

The Hidden World of Money Laundering Launderers use smart techniques to conceal the origin of illicit funds, making it hard to track their destination. As a result, dirty money flows

What are the AML regulations in the UAE?

AML regulations play a critical role in maintaining compliance across both local and international organisations. Furthermore, these rules are vital to detecting and deterring criminals involved in money laundering and

Unlocking AML System Integration: The Key to Safer Finance

Unveiling the Dark Secrets of Money Laundering Integration Money laundering is one of the most dangerous crimes, undermining the economy and threatening businesses worldwide. To effectively combat this growing menace,

What Is Anti-Money Laundering in Simple Terms? Unveiling the Secret

The process of money laundering has three key stages: placement, layering, and integration. The last step, integration, is where illegal money is made to look clean and legitimate. Imagine a

Mastering Anti Money Laundering Policy: A Vital Guide

Introduction to Anti Money Laundering Policy Anti-money laundering (AML) policies play a critical role in curbing illicit activities and ensuring a secure global economy. Furthermore, with financial crime on the

Quick AML Registration for Complete Peace of Mind

Understanding AML Registration Anti-Money Laundering (AML) is vital for maintaining the integrity of financial systems. Enforced by governments, AML Registration laws ensure compliance with international standards. Since 2018, authorities have worked

Anti Money Laundering in UAE: Key Insights for 2024

Anti-Money Laundering (AML) is a critical effort to combat financial crimes and safeguard the economy. In the UAE, AML regulations and CFT guidelines empower supervisory Authorities to identify financial crime

Compliance Services in Dubai: Our Top 3 Expert Solutions

Navigating UAE Regulatory Landscape: Dubai’s reputation as a global commerce hub thrives on its commitment to innovation and a streamlined business environment. However, within this dynamic landscape, navigating the intricate

UAE’s Strategic Goals in Combatting Money Laundering

One of the UAE’s strategic goals in combatting money laundering is to deepen the understanding of risk. This involves conducting comprehensive risk assessments to identify vulnerabilities and emerging trends in

Understanding the Responsibilities of DNFBPs under UAE Law

Who is Considered a DNFBP by MOE under UAE Law? In the United Arab Emirates (UAE), the Ministry of Economy (MOE) plays a crucial role in regulating and supervising the

An Effective Customer Due Diligence Process for Financial Institutions and DNFBPs

Customer due diligence (CDD) is no longer a box-ticking exercise; it’s the cornerstone of a robust compliance framework to ensure compliance with UAE regulators like the Ministry of Economy

Spotting Suspicious Activity? When to File a Suspicious Transaction Report (STR) in the UAE

Spotting Suspicious Activity? When to File a Suspicious Transaction Report (STR) in the UAE The United Arab Emirates (UAE) is a global financial hub, and with that comes a responsibility

TFS in the UAE: A Comprehensive Guide for FIs, DNFBPs, and VASPs

TFS in the UAE: A Comprehensive Guide for FIs, DNFBPs, and VASPs The following is a guide for Financial Institutions (FIs), Designated Non-Financial Businesses and Professions (DNFBPs), and Virtual Asset

A Comprehensive Guide to Customer Due Diligence: Importance, Steps, and Best Practice

Common Challenges in Customer Due Diligence While conducting Customer Due Diligence, companies may encounter several challenges. Some of the common challenges include: Obtaining accurate and up-to-date customer information: One of