Customer due diligence (CDD) is no longer a box-ticking exercise; it’s the cornerstone of a robust compliance framework to ensure compliance with UAE regulators like the Ministry of Economy (MoE) and the Central Bank UAE (CBUAE). Financial institutions (FIs) and DNFBPs have a responsibility to identify and mitigate risks associated with money laundering (ML) and terrorist financing (TF) – and a watertight CDD process is the key to achieving this.

Why is CDD Crucial?

CDD safeguards FIs and DNFBPs from a multitude of threats. By thoroughly vetting customers, you can:

Identify suspicious activity: Understanding your customers’ backgrounds and business activities helps red flag potentially illicit transactions.

Comply with regulations: Anti-money laundering (AML) and Know Your Customer (KYC) regulations are constantly evolving, and a strong CDD process ensures compliance with MoE and CBUAE Standards.

Mitigate reputational risk: Being associated with financial crime can severely damage your reputation. A robust CDD program demonstrates your commitment to ethical practices.

What does an Effective CDD Process entail?

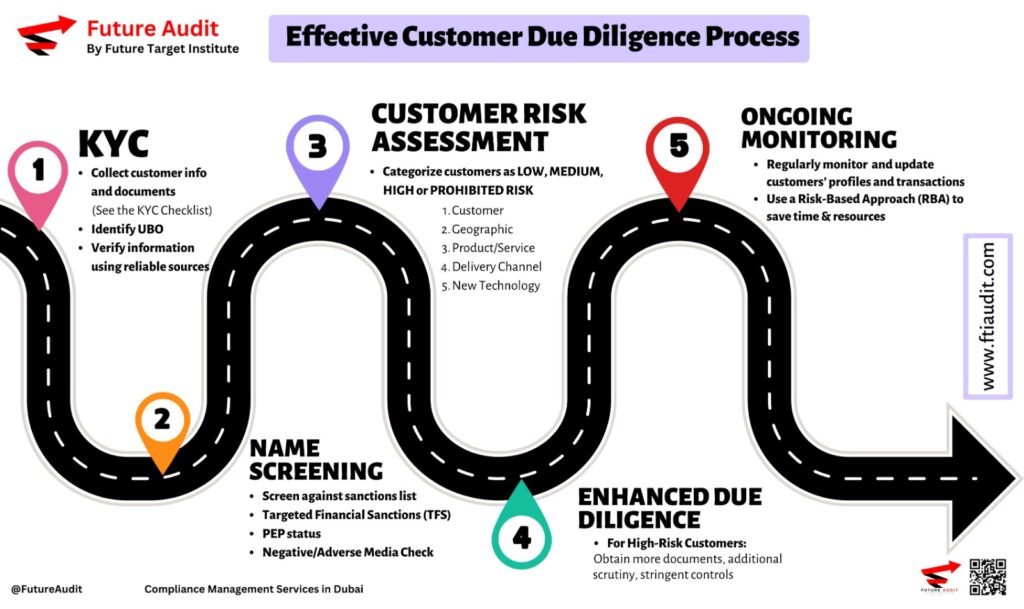

Building a secure CDD process requires a multi-layered approach. Here are some key elements:

1. Customer Identification and Verification: This is the foundation. Verify the identities of all individuals involved, including beneficial owners and authorized signatories. Utilize government-issued IDs, utility bills, and other reliable documents.

2. Understanding the Customer: Don’t just collect data; understand it. Assess the customer’s business nature, source of income, and expected transaction activity. This risk-based approach allows you to tailor due diligence measures accordingly.

3. Ongoing Monitoring: CDD isn’t a one-time event. Continuously monitor customer activity and update their risk profiles as needed. Watch for transactions inconsistent with their profile and investigate any red flags.

4. Technology is Your Ally: Embrace technology to streamline and enhance your CDD process. Utilize sanctions screening tools to check customers against global watchlists and leverage data analytics to identify anomalies.

5. Cultivate a Culture of Compliance: Embed a culture of compliance within your organization. Train staff on CDD procedures and empower them to identify and report suspicious activity.

The Benefits of a Streamlined CDD

By implementing a comprehensive CDD process, FIs and DNFBPs can reap significant rewards:

Reduced Risk: A strong CDD program minimizes the risk of exposure to financial crime and regulatory penalties. Enhanced Efficiency: Technology-driven CDD streamlines onboarding procedures, saving time and resources.

Improved Customer Relationships: A transparent and efficient CDD process fosters trust and strengthens customer relationships.

In today’s complex financial environment, a robust CDD process is not just an option; it’s a necessity. By prioritizing CDD, FIs can safeguard themselves, their customers, and the integrity of the financial system. Remember, a secure CDD program is your fortress against financial crime – build it well, and you’ll build a future of trust and resilience.