The placement stage is the most critical part of money laundering. Here, criminals sneak their illegal money into the banking world, making it seem regular. They use different methods and techniques to hide the source, making detection difficult. However, identifying these transactions early is essential to prevent financial crimes.

The financial system faces a big challenge in tracking suspicious funds. This article will introduce the basics and answer a common question—how does placement work? The banking sector must stay vigilant to detect unusual transactions.

As you read, you will understand how authorities fight against this threat. Finally, taking the right step at the start can stop laundering before it spreads.

Shocking Truth: Placement in Money Laundering!

How Criminals Sneak Dirty Money Into the Financial System

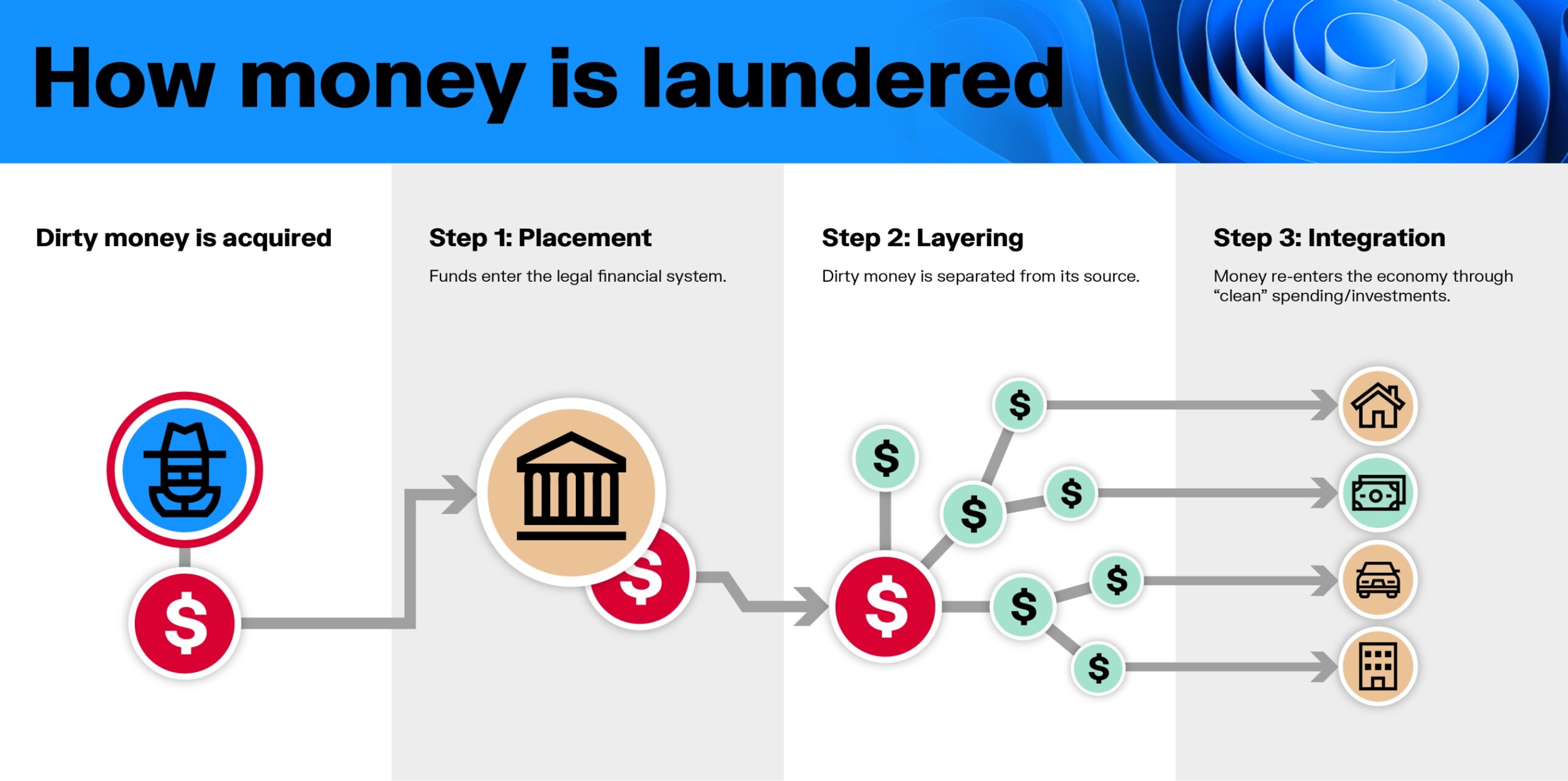

The first step in money laundering is placement, where criminals find ways to insert their illegal gains into the financial system. They use different methods, such as depositing cash, purchasing high-value assets, or buying financial instruments, to make the funds appear seemingly legitimate. The ultimate objective is to disguise the origin of the dirty money, ensuring it does not raise suspicion among banks and regulatory authorities.

Once the funds enter the system, the process shifts to subsequent stages—layering and integration. These steps involve the conversion of illicit proceeds and deeper concealment through complex financial maneuvers. The foundation of successful laundering lies in strategically moving money across various channels to avoid detection. Individuals involved in such schemes often spread assets across multiple accounts, making it harder for investigators to trace transactions.

Success in placement ensures that the money is fully embedded within the legitimate economy. By the time it reaches the final stage, the proceeds merge seamlessly into the system, leaving little evidence of the crime. As a result, law enforcement faces significant challenges, as each step creates additional barriers that complicate investigations.

Sneaky Tactics: Common Placement Methods in Money Laundering!

How Dirty Money Enters the Financial System

Criminals use various techniques to push illicit funds into the financial system while avoiding suspicion. These strategies make detection difficult and allow money to appear legitimate. To achieve this, they rely on several key methods:

- Smuggling: Moving cash across borders to bypass strict AML regulations and introduce money into another jurisdiction.

- Blending: Hiding illicit funds by mixing them with daily earnings from groceries and other cash-intensive businesses.

- Smurfing: Splitting large amounts into smaller deposits across many bank accounts to avoid triggering reporting thresholds.

- Invoice Fraud: Using over-invoicing or under-invoicing to manipulate transactions and obscure the proceeds of crime.

- Stored Value Cards: Buying prepaid cards with dirty money for easy transfer and discreet spending without direct tracking.

- Foreign Currency Purchase: Converting assets into different currencies to diversify holdings and hide the lawful transaction.

- Securities & Insurance: Investing in financial instruments, like stocks or insurance, to make money appear legally acquired.

- Debt Repayment: Using illicit funds to pay off loans or fake debts, making the money seem like a normal value payment.

These methods help criminals in laundering money, allowing them to move it freely within different financial jurisdictions while avoiding detection.

Shocking Example: Placement in Money Laundering!

How a Drug Dealer Moves Illicit Money Into the System

A drug dealer uses different methods to place illicit money into the financial system without raising suspicion. He takes advantage of businesses, weak regulations, and complex transactions to hide his illegal gains. Here’s how he does it:

- Real Estate Acquisition: He invests in mansions, apartments, and compounds to convert cash into tangible assets.

- Front Companies: He sets up enterprises across different industries to disguise the origin of his wealth.

- Cash-Intensive Businesses: He purchases restaurants, hotels, and casinos to mix dirty cash with legal cash flow.

- Bank Accounts Under False Names: He spreads deposits across multiple bank accounts, often under an alias, to avoid scrutiny.

- Smuggling Across Borders: He moves large sums of money to countries with relaxed financial regulations.

- Investments in Public Infrastructure: He funds projects like housing and other initiatives to gain support while hiding his proceeds.

- Money Laundering Networks: He collaborates with expert launderers who use sophisticated schemes and channels to clean the money.

By using these tactics, he successfully places his dirty money into the economy without attracting authorities’ attention.

Hidden Challenges in Detecting Money Laundering Placement!

Why Stopping the First Stage of Money Laundering Is So Difficult

Detecting criminals placing illicit funds is a major challenge. The first stage of money laundering is designed to escape detection, making it difficult for authorities to ascertain illegal transactions and enforce AML procedures.

The fragmented financial ecosystem makes prevention even harder. With multiple entry points and diverse financial institutions, criminals easily exploit weak monitoring and loose regulations. A lack of transparency allows funds to move without triggering detection systems.

Sophisticated laundering methods, such as trade-based laundering and structuring, make tracking even harder. These tactics add complexity, reducing the effectiveness of oversight and making it difficult to prevent illegal flows.

Because money laundering is a global issue, criminals use cross-border transfers to stay ahead. Without strong international collaboration, tracking financial transactions across different financial institutions becomes nearly impossible.

Cryptocurrency adds another challenge. The anonymity of digital assets helps criminals bypass anti-money laundering efforts, making combating illicit financial activities much harder. Traditional banks struggle to trace funds in decentralized finance.

Many financial institutions also face resource constraints. Without the right technology, automation, or skilled personnel, detection and monitoring become weak. Limited budgets and outdated tools create loopholes criminals exploit.

The human factor is another weakness. Poor training, failure to follow best practices, and weak implementation of measures allow illegal funds to slip through. Even strong policies fail without proper enforcement.

To stay ahead, continuous progress in implementing advanced systems is essential. Strengthening effectiveness and adapting to new risks are key to stopping money laundering at its roots.

Detecting and Preventing Money Laundering Placement!

How to Strengthen Detection and Prevention Strategies

Stopping suspicious transactions early is crucial. Financial institutions must use strong compliance procedures and advanced monitoring tools to fight money laundering. Criminals rely on various placement techniques, making detection harder. Here’s how institutions can respond effectively:

- Use Artificial Intelligence & Machine Learning: These technologies analyze transactions, detect patterns, and flag risks in anti-money laundering efforts.

- Strengthen KYC Processes & Customer Due Diligence: Verifying customer identities and conducting Enhanced Due Diligence prevent illicit cash deposits and risky asset purchases.

- Conduct Regular Audits & Risk Assessments: Reviewing high-risk areas ensures compliance procedures stay effective against new money laundering threats.

- Collaborate with Regulatory Bodies & Law Enforcement Agencies: Sharing intelligence through networks and forums improves global enforcement efforts.

- Leverage Regulatory Resources & Best Practices: Organizations like the United Nations Office on Drugs and Crime offer guidance on strengthening prevention strategies.

- Implement a Risk-Based Approach: Prioritizing resources in critical areas enhances measures and stops placement techniques before they escalate.

These strategies help financial institutions stay ahead of criminals and make detection more effective.

Conclusion

Money laundering is a dangerous crime that hides illegal money from fraud and drug trafficking. The process follows three stages: placement, layering, and integration, making it hard to trace illegally obtained funds. Criminals conceal their activities by blending dirty money with legal money, making detection even harder.

To effectively fight this, financial institutions must strengthen Anti-Money Laundering (AML) efforts. They should focus on screening customers, tracking transactions, and using advanced technology to detect unusual activity. Strong AML systems help identify risks early and prevent criminals from exploiting loopholes.

By improving monitoring, institutions can spot suspicious movements and tackle money laundering before it spreads. A proactive approach ensures a safer financial system and reduces illegal activity.

FAQs

Q1. What happens during the placement stage of money laundering?

The placement stage is the first stage of money laundering, where criminals introduce illegal funds into the legitimate financial system. They use different methods, such as cash deposits, purchasing assets, or moving money through restaurants, hotels, and casinos to hide its true origin.

Q2. Why is the placement stage risky for criminals?

This stage is the most vulnerable because it involves handling cash from illegal activities. Financial institutions use anti-money laundering measures to detect and prevent illicit fund placement, making it harder to avoid scrutiny.

Q3. What rules help prevent money laundering placement?

Strict regulatory measures, global frameworks, and compliance procedures help stop criminals. Financial institutions and international entities work together in collaboration to track illegal transactions and improve detection efforts.

Q4. Which industries are most targeted for money laundering placement?

High-risk industries include casinos, bars, nightclubs, antique dealers, and the art market. These businesses handle large cash flows, making them attractive for laundering money.